The new standard concerning leases provides a single lessee accounting model, requiring lessees to recognise assets and liabilities for all leases with lease terms exceeding 12 months, unless the leased asset has a low value.

The lessee will prove the right to use an asset which will reflect their right to use the leased assets and the liability as the obligation to make lease payments.

With regard to lessors, IFRS 16 – Leases copies the solutions adopted in IAS 17 – Leases.

Therefore, lessors will continue to classify leases as operating or finance leases.

IFRS 16 replaces:

- MSR 17 Leases

- IFRIC 4 – Determining Whether an Arrangement Contains a Lease

- SIC-15 – Operating Leases – Incentives

- SIC-27 – Evaluating the Substance of Transactions in the Legal Form of a Lease

- When a contract is made, an entity should assess whether it is a lease or only contains lease components

- From contracts which contain lease and non-lease components, non-lease components must be separated, e.g. the maintenance of assets subject to the contract.

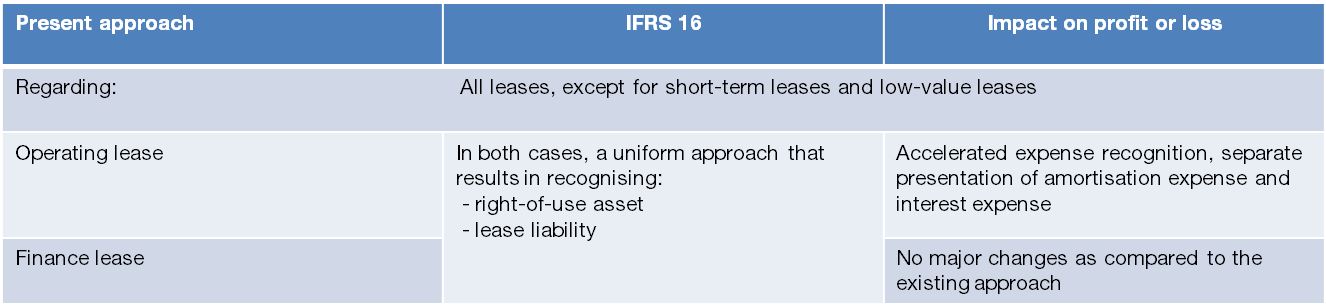

The comparison of the proposed lease model with the existing approach:

NOTE: Many leases of equipment and cars which, under the existing regulations, are classified as operating leases (e.g. leases of equipment for which the lease term is an insignificant part of the total useful life) will be recognised and accounted for like the finance lease so far. As compared to the existing approach to this type of leases, the new approach will result in accelerated expense recognition.

- The new standard will become effective for annual periods beginning on or after 1 January 2019.

- Earlier adoption is permitted if IFRS 15 has already been applied or will be applied from the same point in time.

- Available grandfathering rule for lease definition under IFRIC 4 Determining Whether an Arrangement Contains a Lease (no re-assessment for all contracts existing upon the adoption of the Standard).

- Lessees may choose the full or modified retrospective approach to transition to the new standard (for all contracts).

- Without adjustment of comparative information, recognition of the liability at the value of current remaining payments.

- Current balances under finance leases are transferred as at the effective date of the standard.

- Lessors transfer current balances as at the effective date of the standard.

- Disclosures required as per IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors with certain exceptions.

We provide IFRS 16 and other services throughout Poland in regional offices in Warsaw, Łódź and Poznań, Opole, Wrocław, Katowice, Lublin, Gdańsk and Zielona Góra.

Quick contact

PKF News

News, alerts, and events - Useful, last-minute information.

Wypełnienie pola oznacza wyrażenie zgody na otrzymywanie komunikacji marketingowej. Administratorem danych jest PKF Consult Sp. z o.o. Sp. k. ... więcej

Thank you for your trust! Your address has been saved in our database.