The article by PKF expert (Grażyna Sadowska- Malczewska – Managing Partner of PKF BPO).

In this episode of the “Keep abreast of management accounting” cycle, I am facing a difficult question – Can simplified accounting lead a company to bankruptcy? What is the impact of a properly adapted accounting- and internal processes system on the effective management, safety and success of the company?

“Grażyna, help! The bank has terminated our loan agreement!”

To illustrate the problem that an inadequate financial accounting system may pose and the consequences of the lack of a management accounting system, I’m going to show you the case of a booming client who approached us a few months ago in despair. His lack of alertness and failure to take timely action almost put him on the brink of bankruptcy when his loan agreement was suddenly terminated.

For many years, our client had been successful in online training for children

and young people. Two years ago, he decided to implement a cutting edge education platform. He engaged programmers to build the technology and teachers to develop training curricula and materials. The investment was to be used by the company for years, but the company applied simplifications in its accounting records; as a result, all investment costs were reflected in the profit and loss account without being capitalized in the balance sheet. As a consequence, the financial data presented to the bank showed a great loss; that in turn made the bank terminate the client’s loan agreement and led the company to bankruptcy.

José Martí used to say that progress has no greater enemy than habit. It was habit, rather than alertness, that got our client into trouble. Simplified accounting worked fine until the company started to thrive. It made it possible for the company to meet the legal requirements, carry out the necessary calculations, calculate and transfer taxes in the amount due. However, as the business started to grow, managers started to struggle to maintain control of all aspects of the business. The use of simplifications in accounting records that were inadequate to the company's standing and operations led to the lack of adequate financial data and key management information in a timely manner.

Fortunately, we were able to remedy the situation. We made the relevant adjustments to the books of accounts that were transferred to the bank and, most importantly, we designed and implemented a management reporting system with the client, which now allows the client to analyze the profitability of products and services, and supports its decision-making process.

Main errors and challenges in the implementation of the management accounting and controlling system

It’s been my experience that managers delay adapting internal processes to the company's development and the ever-changing environment, and often do it when it’s too late. Being victims of their own success, companies may encounter a number of issues related to the lack of adequate management data.

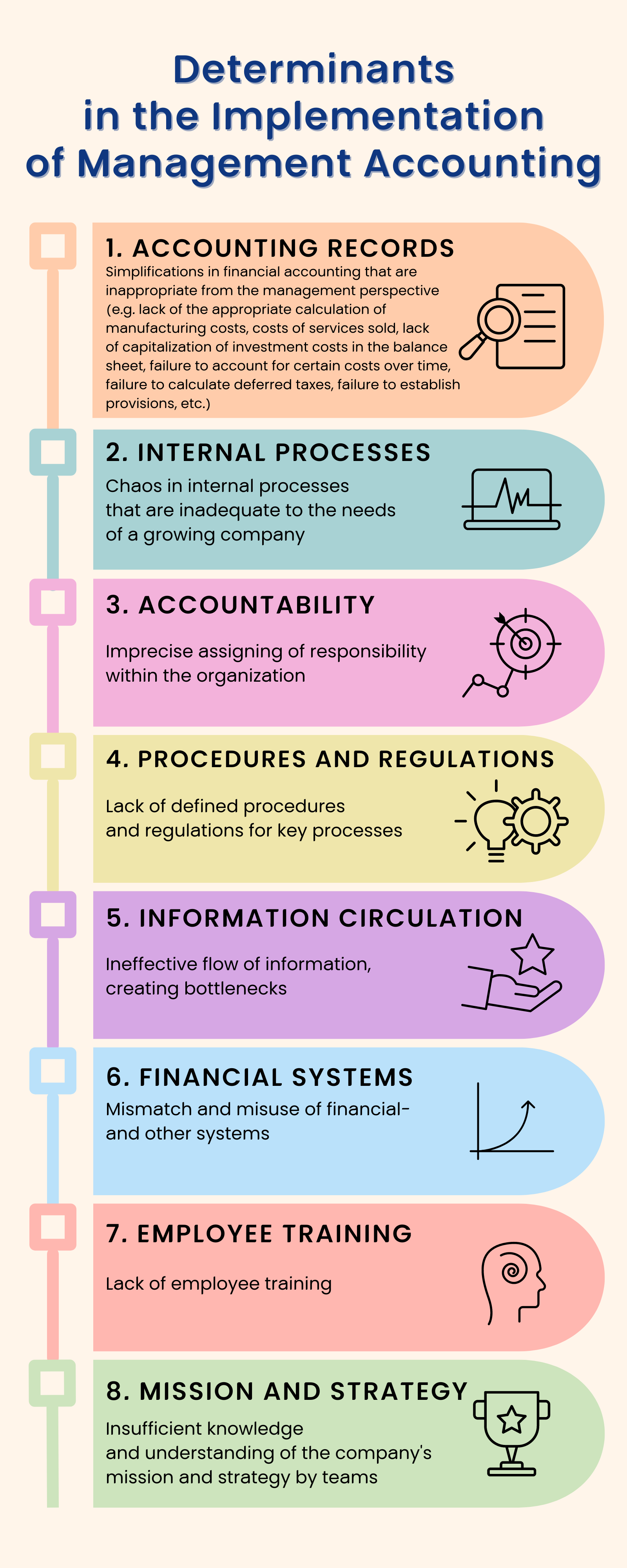

The graph below presents the main areas of concern impacting the implementation process and effective functioning of the company's management accounting and controlling system.

Thanks to the experience gained during multiple internal audits in various companies, I am fully confident that the analysis and implementation of improvements in those areas made it possible to create an effective and satisfactory management accounting system.

Why do I place such an emphasis on internal processes? As already mentioned in my previous article in the series “Keep abreast of management accounting”, management accounting has a completely different function from traditional accounting. The key aspect here is the time during which the data is provided. Data must not only be valuable and support managers in making the right decisions, but they must also be provided without undue delay. Even the most accurate information, if provided late, becomes irrelevant in terms of building a competitive advantage and responding to potential risks.

Therefore, efficient internal processes and regular assessment of whether modifications are necessary play a key role in building an effective management accounting system. Each of those elements is extremely important.

For example, the use of simplifications that are inadequate in financial accounting from the perspective of management needs may lead to excessive delays in the delivery of management data, which reduces their value in the management process. Problems with document workflow, bottlenecks or lengthy processes often have a significant impact and lead to delays in data delivery.

The lack of clearly written employee responsibilities leads to a blurring of responsibilities, which may lead to errors and omissions of material issues, thus adversely affecting the completeness of the data provided. Unmanaged risks and opportunities remain unnoticed and unaddressed.

How to implement the management accounting system?

There is no universal solution for implementing the management accounting system as each company is unique. The management accounting and controlling system must be tailored to the company's individual needs, organizational culture, customers and development stage.

Habit vs progress, or the art of agile adaptation in company management

Concluding, the story of our client is an example of how important adequate management of internal processes within the company is. It just goes to show you that, without adequate support from management accounting, even the most promising investment project can lead to unexpected financial consequences and, in the extreme case, to bankruptcy.

“Habit is a trap in which you can easily fall, but from which you can emerge if only you are ready for change” – that could be the motto of our case study. Too late adjustment of internal processes and accounting systems to the growing needs of the company, underestimating the importance of detailed management data or neglecting continuous monitoring and updating of procedures can result in serious problems.

It should be crucial for managers to realize that in a rapidly growing business world where change is the only constant, flexibility and readiness to adapt accounting and management control systems to the company's current needs is not only an added value, but a necessity. It is those aspects that determine a company's ability to anticipate threats, respond effectively to the changing market conditions and build a sustainable competitive advantage.

Therefore, whether you are at the beginning of your company's development path or at the expansion stage, please make sure that you check your processes and systems on a regular basis. Make sure your company is not only fighting for survival, but also thriving and growing, leveraging all the available data to strategically plan and make smart decisions. Let our case study remind you that continuous improvement and readiness for change are key to success in managing a company's finances, just as they are key to success in personal life.

Do you want to implement a management accounting system in your company? Contact us!

You may be interested

PKF News

News, alerts, and events - Useful, last-minute information.

Wypełnienie pola oznacza wyrażenie zgody na otrzymywanie komunikacji marketingowej. Administratorem danych jest PKF Consult Sp. z o.o. Sp. k. ... więcej

Thank you for your trust! Your address has been saved in our database.