The article by PKF expert (Grażyna Sadowska- Malczewska – Managing Partner of PKF BPO).

“Business is a continual dealing with the future; it is a continual calculation, an instinctive exercise in foresight”, said Time and Fortune publisher Henry R. Luce. These words perfectly introduce the topic of today’s article in the ‘Fall in Love with Management Accounting’ series. This is because we will look at budgeting – a critical tool that, despite its agility, can become a powerful ally in each company’s strategic planning. What are the challenges of the budgeting process and why should it be used?

Budgeting is one of the instruments of management accounting that supports the achievement of business goals. This is a process that involves designing, creating and approving budgets, as well as their subsequent control. Budgeting is the result of planning development intentions of a company, indicating the goals and directions of its operations, as well as how its resources are to be used.

Role of budgeting in the development strategy of a company

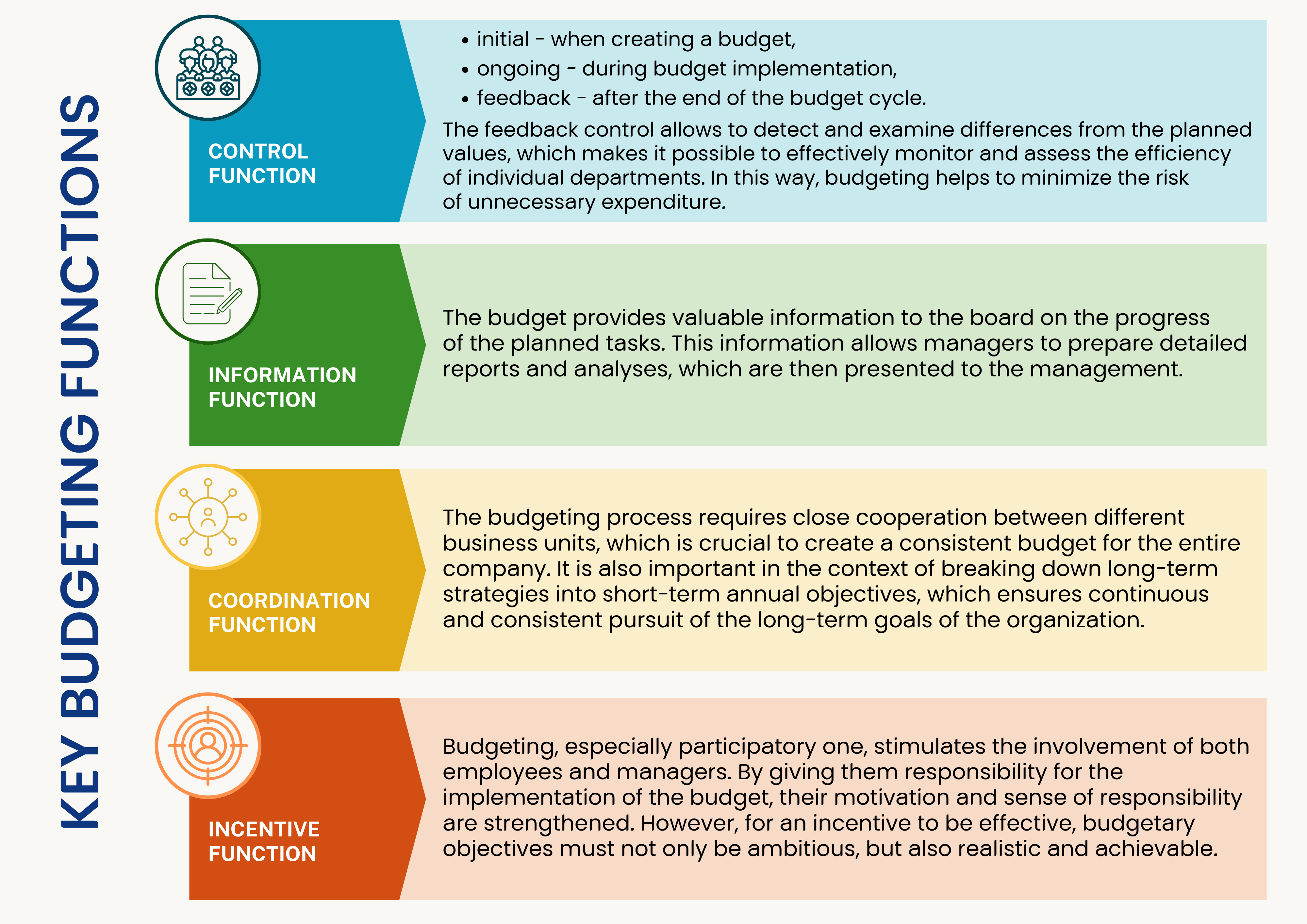

The budget plays a crucial role in the management of a company and performs various functions. The following diagram presents four key budgeting functions:

Budgetary strategies: types, advantages, disadvantages

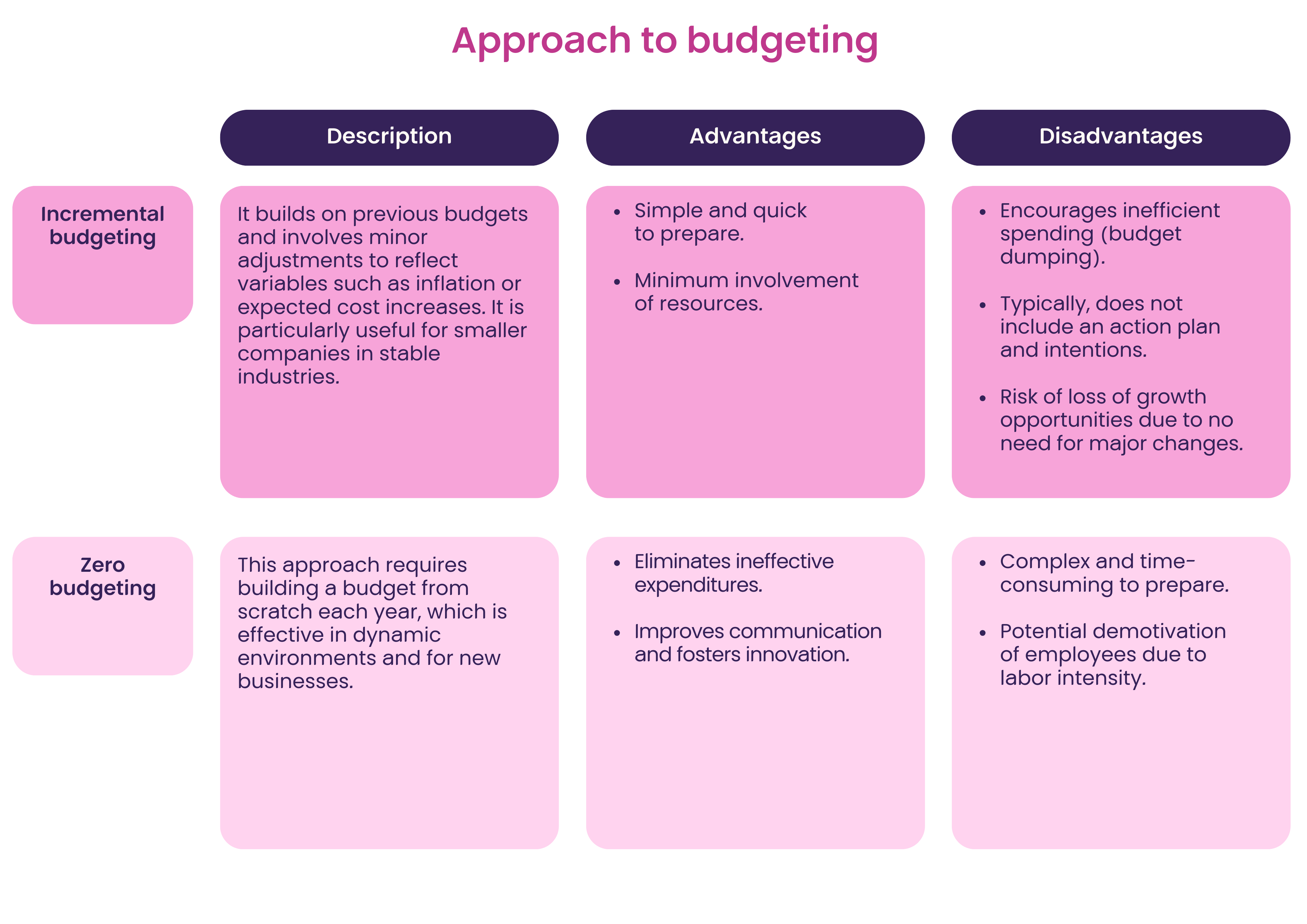

Budgeting is like raising children – there is no universal prescription. It is a complex process that does not provide a one-size-fits-all solution for every organization. Different types of budgets offer unique benefits and challenges, depending on the specific nature and needs of a company. Below, please find key approaches to budgeting that can be followed in different economic and organizational circumstances.

Each of these approaches is included in the arsenal of financial tools of an organization, and the choice of the appropriate type of budgeting should be determined by the nature of the business, dynamics of the environment and strategic objectives of the company.

Recommended approach to budgeting

Regardless of the approach chosen, it must be understood that the performance of a company is the result of real actions and not just figures budgeted. The company’s business processes are a system of connected vessels and form the foundation that ultimately shapes its financial position.

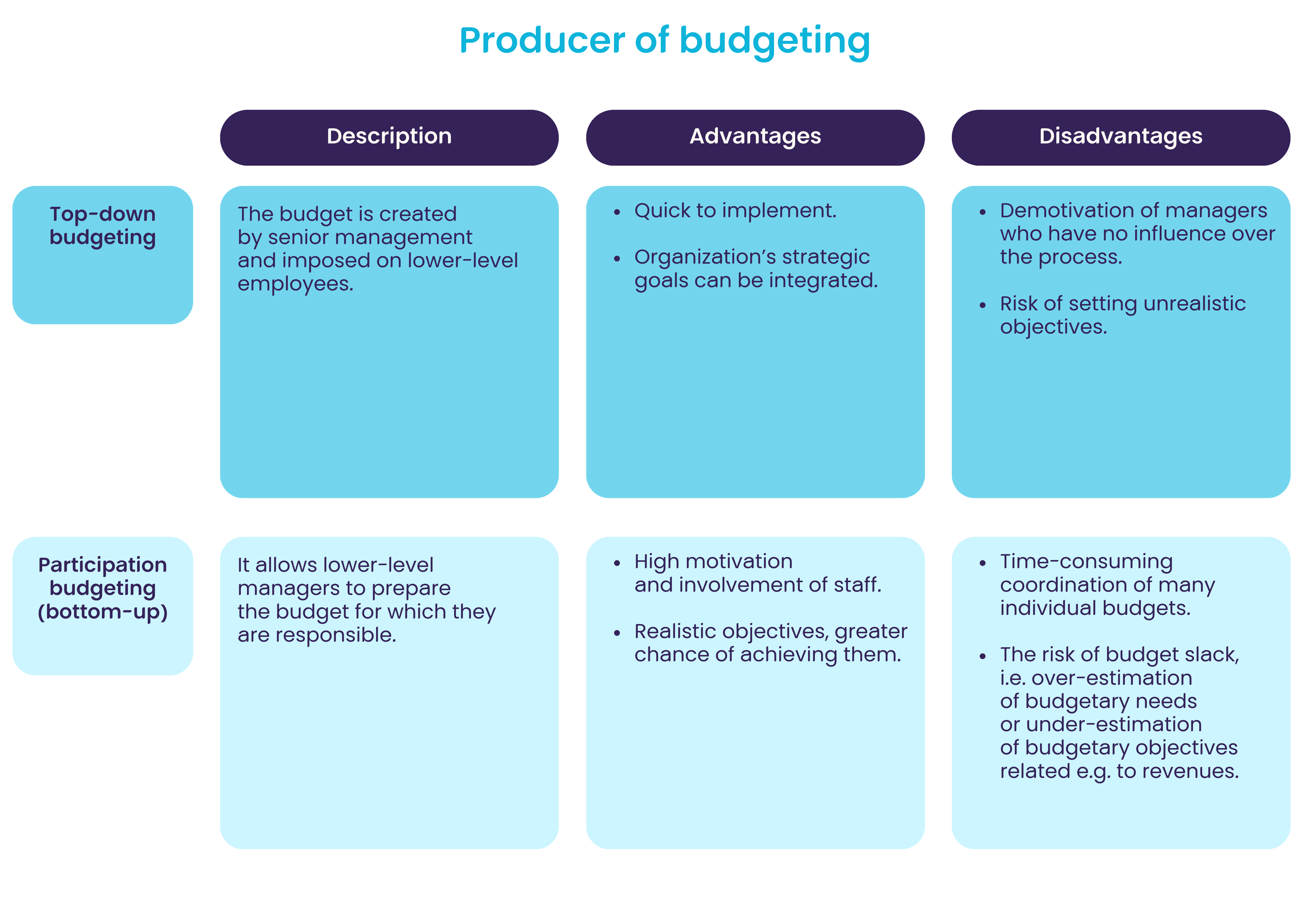

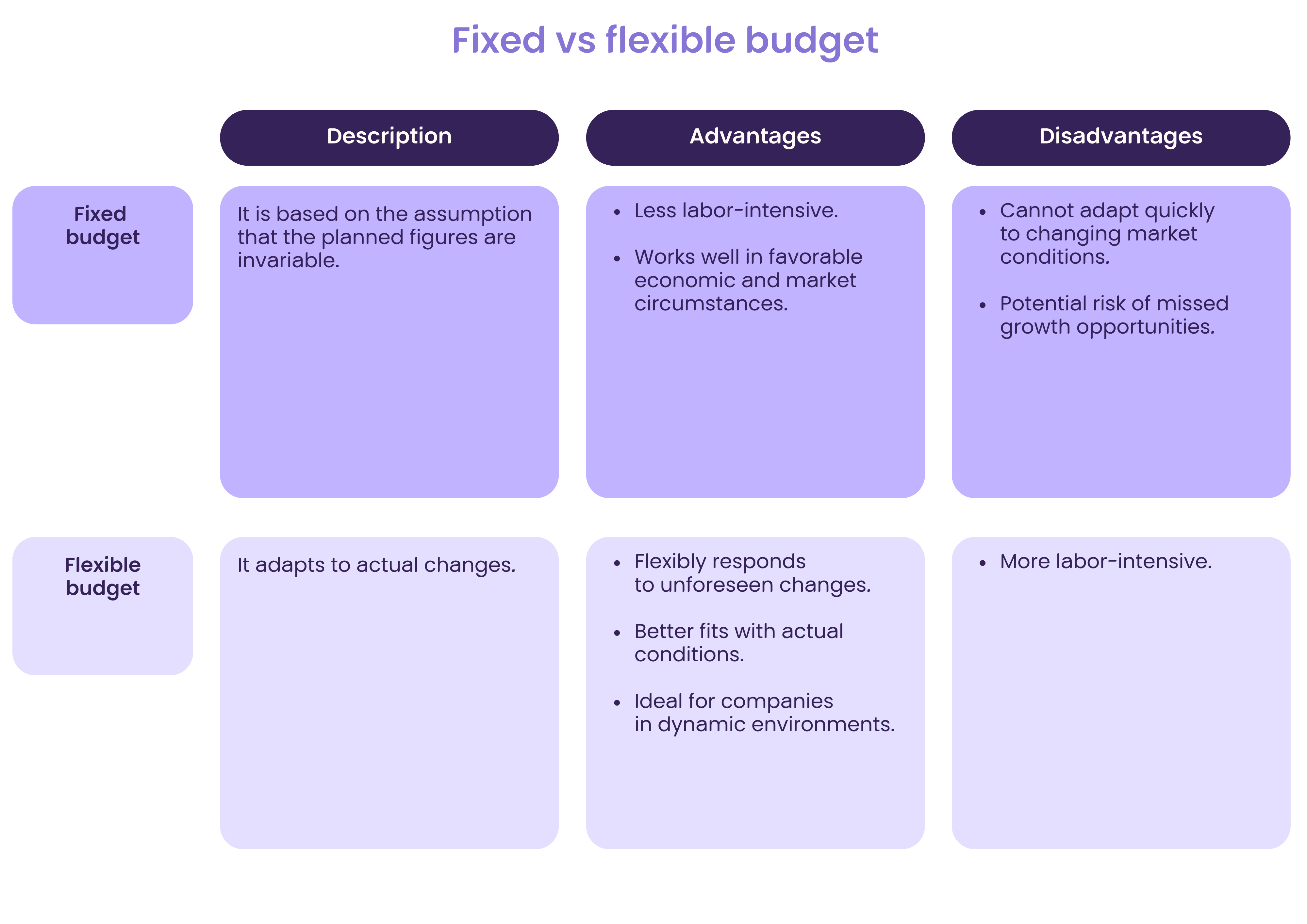

Personally, I am closer to the position that participatory budgeting and a flexible approach to budgeting is a better solution. It allows for greater involvement of employees and adaptation to changing circumstances, which in turn can result in better performance and greater innovation.

In my opinion, however, a crucial element should be task-oriented budgeting, which means that every element of the budget should be supported by specific, well-thought-out actions. This ensures that financial planning is closely linked to the company’s real strategic and operational goals and that its execution can be effectively monitored, controlled, evaluated and adjusted.

Crucial importance of strategic task budgeting in organizations

Task budgeting, as an advanced form of strategic planning, is crucial not only for effective financial management through detailed task planning, but also facilitates more accurate monitoring of the effectiveness of organizational activities. This process goes beyond simple analysis of figures, providing insight into how individual activities affect the operation and growth of the company as a whole.

When planning and budgeting tasks, we are able to accurately assess what resources are necessary to execute our plans or whether our internal processes, systems, technologies and employees are well prepared for these challenges, and to identify potential risks, constraints and bottlenecks.

Such an analysis allows to determine optimal paths to achieve goals, assign responsibilities and introduce necessary organizational changes.

Bottom-up budgeting plays a significant role as employees who are personally involved in the budgeting process are more motivated to implement the budget and identify with the company’s goals.

This approach not only drives strategy formulation, but also helps prepare the organization for achieving future goals and increases its operational agility.

Additionally, the integration of cost management and controlling with the task budgeting process allows for accurate accounting of assumptions and continuous measurement of the effectiveness of each task. These tools are a crucial element of the process that translates into better financial and operational performance of the entire organization.

Please also note that the entire budgeting methodology should be compatible with the controlling system, relevant accounting records and management accounting. This often requires customization of internal processes, accounting policies, chart of accounts or various systems such as financial and accounting systems, warehousing systems, CRM, HR and payroll programs, and RCP, which is necessary to ensure operational consistency and efficiency.

Not only figures count... Financial and non-financial KPIs

Throughout the entire budgeting process, it is worth considering implementing not only financial objectives (financial KPIs), but also incorporating non-financial KPIs into our strategy. These non-financial indicators, such as customer satisfaction, product quality, process efficiency or employee involvement, are equally important as they focus on the long-term value and sustainability of the organization.

Let us remember that an organization is a complex machine made up of numerous cogs that are closely interconnected. For this mechanism to function effectively, each of these cogs, or processes, is essential. It is all the more important that the objectives and KPIs for individual departments, teams and managers are not based solely on financial data. When examining each of them, the goals of the company as a whole and its long-term growth should be taken into account.

Take, for example, the sales department, which within its financial KPIs is usually responsible for generating a certain level of revenue, which will ultimately be reflected in the annual income statement. However, non-financial KPIs may also include indicators related to the preparation of new products or services for sale. Although revenues from these activities will not be directly included in profit or loss, they are critical to the company’s development and strategy.

Similarly, the HR department, measured by employee turnover indicators, should drive long-term benefits that align with the strategic goals of the entire company. The use of non-financial KPIs helps avoid the pitfalls of short-sighted decisions that may lead to dysfunctional behavior within the organization.

“The path to success is to take massive, determined action” – Anthony Robbins

Proper preparation for the budgeting process is as important as its correct implementation. Organizations should start working on the budget well in advance in order to avoid the rush that can lead to missing key stages of budgeting work, planning and discussing objectives. My experience shows that the optimum time to start working on the first budget assumptions is before the summer holidays, as it allows to collect initial data from both inside the organization and from its environment.

This planned and systematic approach to budgeting not only allows organizations to better prepare for the challenges ahead, but also increases the chances of successfully achieving their strategic objectives. Although not an easy task, budgeting is an effort worth making. I hope that I have managed to convince my readers that it is worth spending time to prepare a sound budget, which often requires many weeks of work.

Budgeting is much more than a control tool; it allows for efficient management of resources and achievement of long-term goals. Incorporating both financial and non-financial KPIs into the management system provides a comprehensive view of the organization’s performance, allowing the strategy to be better aligned with rapidly changing market realities. In the face of constant change and uncertainty, competent budgeting is not just an opportunity, but a necessity that allows organizations not only to survive, but also to grow, ahead of competition and achieving their goals. Budgetary control, exercised with due diligence and regularity, ensures that every resource is used where it is most needed, contributing to building solid foundations for future success.

As I mentioned at the beginning, budgeting is a powerful tool for building a company’s strategy and it is difficult to cover all relevant information related to this topic in one article. In the next ‘Fall in Love with Management Accounting’ article, I would like to present how to get on with budgeting, what are its stages and what to pay attention to when preparing a controlling system linked to the budget.

You may be interested

PKF News

News, alerts, and events - Useful, last-minute information.

Wypełnienie pola oznacza wyrażenie zgody na otrzymywanie komunikacji marketingowej. Administratorem danych jest PKF Consult Sp. z o.o. Sp. k. ... więcej

Thank you for your trust! Your address has been saved in our database.