The core principle of the new standard is the recognition of revenue so as to depict the transfer of goods or services in an amount to which the entity expects to be entitled in exchange for delivered goods/services. Pursuant to the new regulations, revenue arises when the control over goods or services passes to the customer.

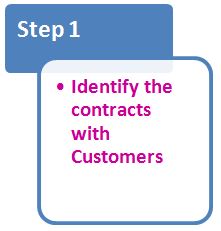

The standard proposes the 5-step approach to revenue recognition:

|

In this step, an entity should analyse which contracts must be combined under IFRS 15 and how to treat the modification of contracts. For example, should an additional construction contract to construct a footbridge near a housing estate be combined with the main contract for the construction of the housing estate or be treated as a separate contract?

|

|

In this step, an entity should:

For example, the sales of a machine with assembly and maintenance services — which of these performances form a single obligation and which of them are separate and independent performances.

|

|

According to the Standard, the price of the transaction (individual contractual performances) should take into account:

|

|

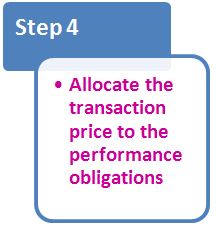

The transaction price (taking into account the components identified in Step 3, is usually allocated by reference to their relative standalone selling prices).

|

|

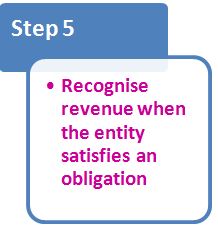

Revenue is recognised when (or as) the entity satisfies performance obligations (goods and services are transferred). A good is transferred and a service is performed when the customer gains control of them (‘risks and rewards’ have been abandoned). |

We provide IFRS 15 and other services throughout Poland in regional offices in Warsaw, Łódź and Poznań, Opole, Wrocław, Katowice, Lublin, Gdańsk, Zielona Góra and Szczecin.

Quick contact

PKF News

News, alerts, and events - Useful, last-minute information.

Wypełnienie pola oznacza wyrażenie zgody na otrzymywanie komunikacji marketingowej. Administratorem danych jest PKF Consult Sp. z o.o. Sp. k. ... więcej

Thank you for your trust! Your address has been saved in our database.