* Other comprehensive income

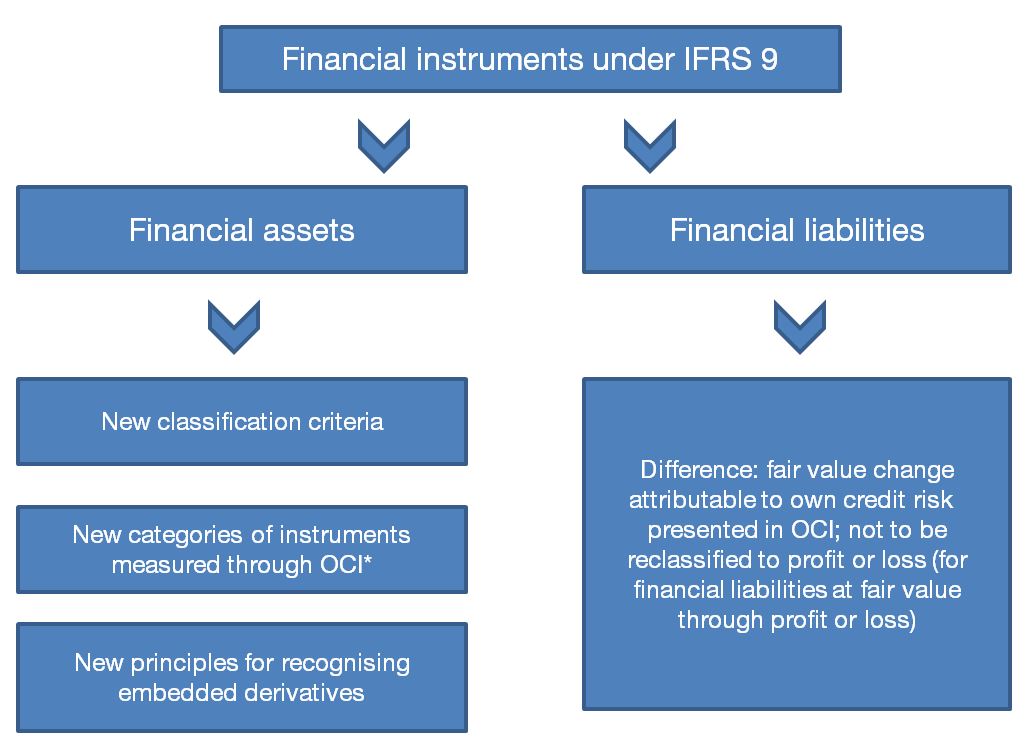

The new regulations provide for a different classification of financial instruments.

Under IFRS 9, an entity will classify financial instruments into two categories (IAS 39 distinguished 4 categories):

- Financial instruments measured at amortised cost

- Financial instruments measured at fair value

The new classification depends on two criteria:

- Adopted business model for managing the financial assets

- A financial asset’s contractual cash flow characteristics

An entity accounts for a financial instrument as measured at amortised cost, if it meets the following conditions:

- The adopted business model is to hold the asset to collect the contractual cash flows

- The contractual cash flows for the instrument are solely payments of principal and interest.

Financial instruments not meeting the aforementioned criteria are measured at fair value.

The aforementioned criteria point to the fact that all equity instruments are measured at fair value.

The general principle under IFRS 9 provides that gains and losses from the measurement are recognised in profit or loss.

However, there is an exception to this rule. This exception applies to equity instruments which are not held for trading. Gains and losses on such instruments may be presented by an entity in other comprehensive income if the entity choses so upon initial recognition. It should be noted here that such a choice is irrevocable.

We provide IFRS 9 and other services throughout Poland in regional offices in Warsaw, Łódź and Poznań, Opole, Wrocław, Katowice, Lublin, Gdańsk, Zielona Góra and Szczecin.

Quick contact

PKF News

News, alerts, and events - Useful, last-minute information.

Wypełnienie pola oznacza wyrażenie zgody na otrzymywanie komunikacji marketingowej. Administratorem danych jest PKF Consult Sp. z o.o. Sp. k. ... więcej

Thank you for your trust! Your address has been saved in our database.