The article by PKF expert (Grażyna Sadowska- Malczewska – Managing Partner of PKF BPO).

“It is a big mistake to be theoretical before the exact data is available” – these are the words that Sir Arthur Conan Doyle put into the mouth of Sherlock Holmes. Our task, as entrepreneurs, is to become a detective and find sense in the guidance provided by our own company. Its greatest resource, which unfortunately is not always well used, is data.

Valuable resource that you need to know how to use

As an entrepreneur, you probably know the situation when, in the array of tasks and incoming information, you feel decision paralysis and fatigue. Some of us feel it permanently. Psychologists describe it as an information stress. Our role is to learn to reject the information noise and extract valuable content from it, which we then use for the benefit of our business.

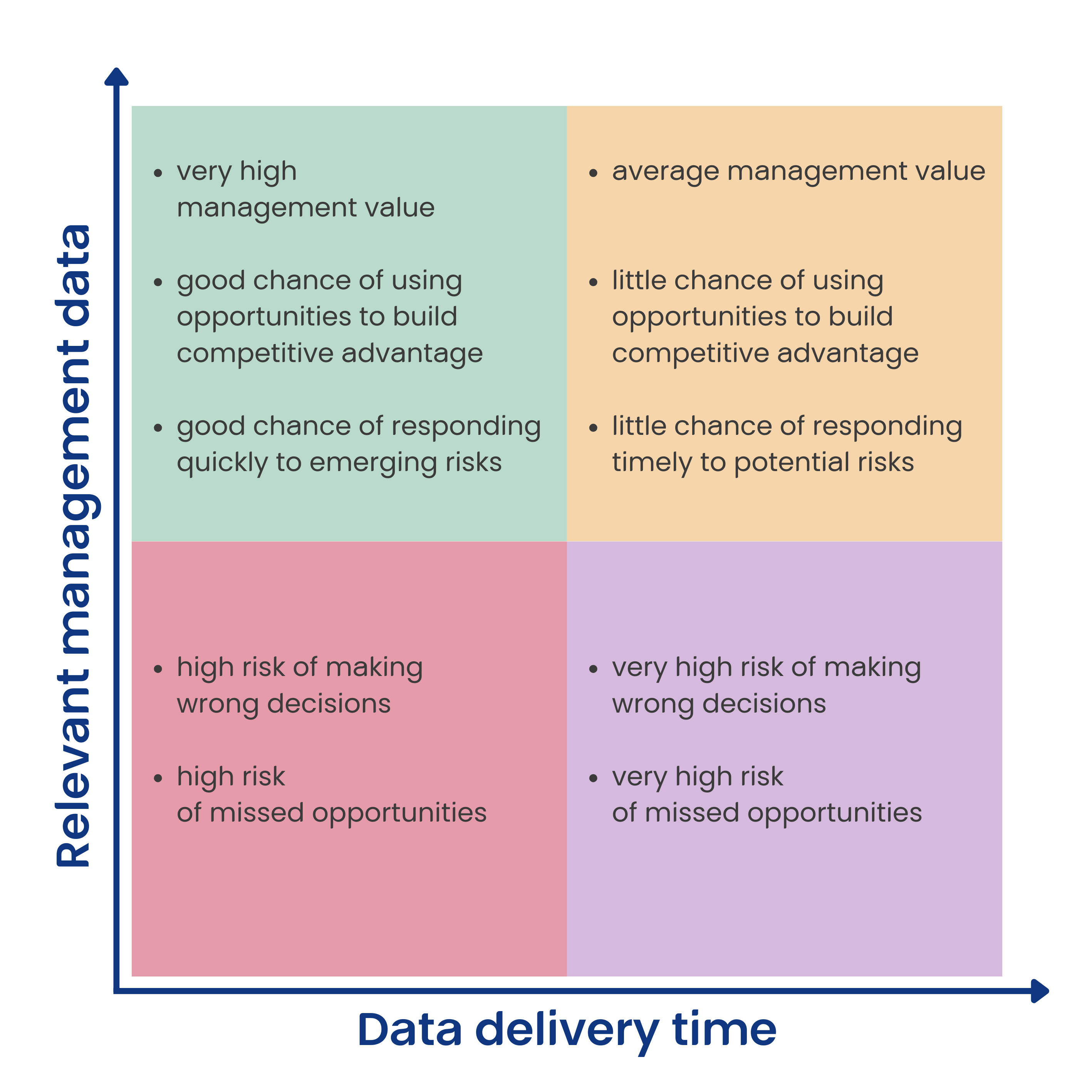

Time is also of importance here. In the age of AI and other digital tools, data analysis can be done by anyone. However, market advantage is gained by the company that will reach out to the data and make the right decisions at the right time – faster than its competitors. Even the most extensive and in-depth analyses have a use-by date, especially in a context of rapidly changing market and constant geopolitical changes.

The combination of effective use of two factors – KNOWLEDGE and TIME – is what management should strive for to ensure that its decisions are based on the right foundations.

Financial accounting vs. management accounting, i.e. how to use the data

In order to sort out the information chaos, a company’s board of directors does not need to have economic or financial knowledge. What matters is choosing the right tools. Especially in mid-sized and large enterprises, where data is large and comes from different sources. An effective solution is to have a well-designed financial controlling and to establish an internal department in charge of financial and management accounting or to outsource these activities.

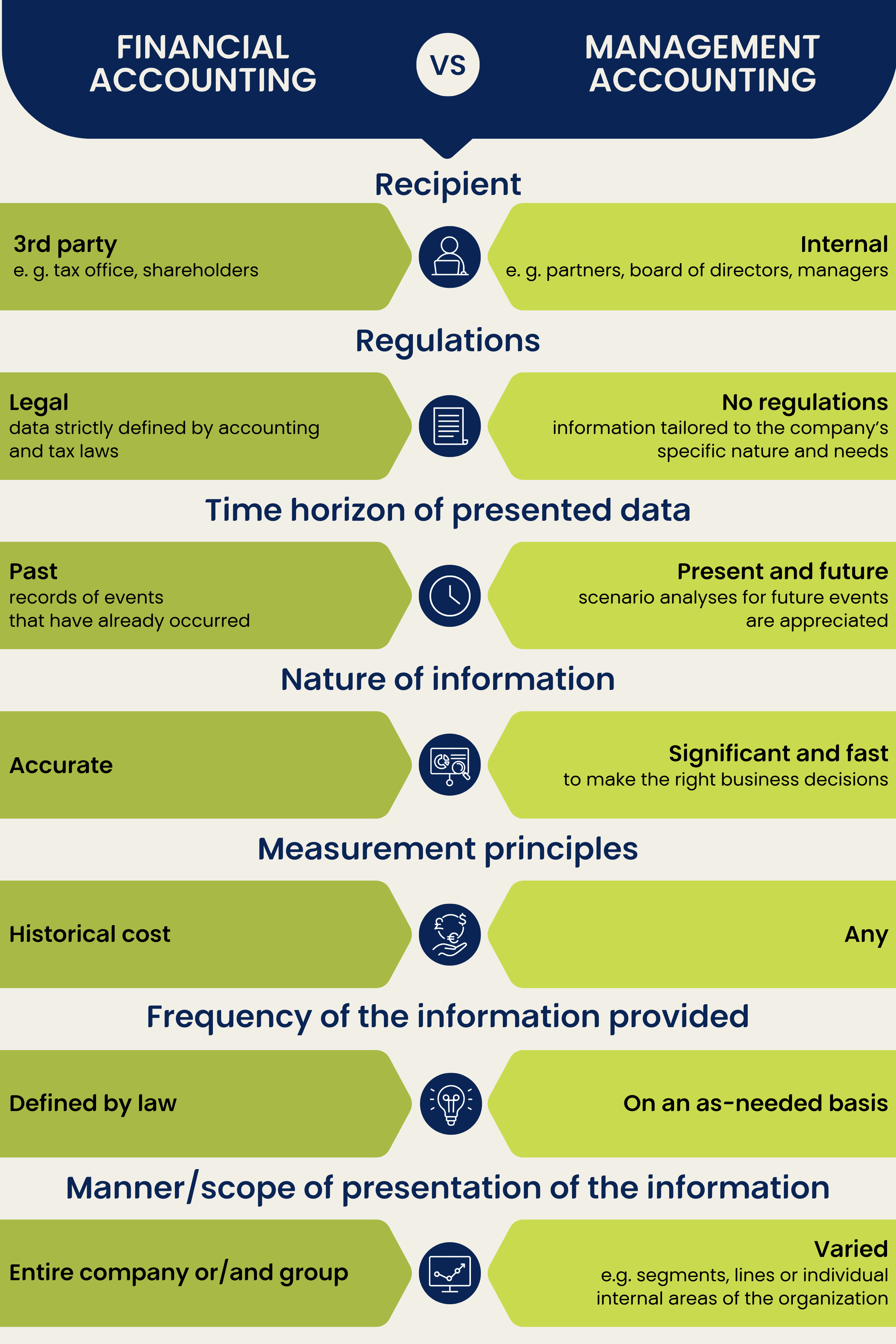

Usually, when Clients ask me about differences between these services, my response is that what makes them different is the RECIPIENT of the data derived from them.

- Financial accounting follows from a legal obligation and is carried out mainly for the benefit of a third-party recipient, e.g. a tax office, banks, lessors or shareholders. It provides them with an overview of the financial standing of the company (assuming, of course, that books are kept accurately and provide a good basis for further analysis);

- Management accounting is implemented on a voluntary basis. It is to provide information to the supervisory board, board of directors, partners and all those who can influence the decision-making and building of a long-term development strategy. It affects the decisions that the broadly understood company will make to achieve its goal.

The chart below identifies seven main areas that distinguish financial accounting from management accounting.

System of connected vessels – good analyses are based on good data

My Clients often ask the question of how to prepare for the use of information provided by management accounting. My response is that in order to start talking about setting up an appropriate system of management accounting and controlling, we must first look at the data we have and how it is obtained. It is very important to take a considered approach to financial accounting, designing of internal processes, procedures, bank accounts and even the tools used, such as CRMs, warehouse systems and the like. If these elements work together like well-fitting pieces of a jigsaw puzzle, we will be able to obtain the data we provide to management accounting quickly enough without wasting time processing it.

If this phase is completed successfully, then the next question is how to create a management accounting system that will bring real benefits to the company.

Start with accounting

What counts in financial accounting is the quality. Accurate accounting is the basis for reliable management accounting. It is therefore worth bearing in mind that not every accounting office may be suitable for your business profile. The choice of such office should be based primarily on the experience and knowledge of your industry.

The overarching objective of an accountant is to keep accurate (the saying “every penny must add up” did not come from nowhere) and adequate records of economic events that reflect the actual economic standing of the company. In addition, in order to avoid unpleasant financial consequences, financial accounting should be carried out on the basis of strict legal guidelines: from the Accounting Act starting through tax law to national and international accounting standards.

Financial accounting relies less on speed, but the rhythm of its work and data production is based on the cyclical need to report. So, if your accounting office works accurately and reliably, the data needed in the next step will be reliable and easily available.

Fast and effective, or how management accounting works

Compared to financial accounting, management accounting operates here and now. The main focus is on:

- TIME in which the data is provided; and

- selecting INFORMATION that is of value to managers under the current circumstances and will help them make the right decisions.

As I have already stressed, financial accounting must be constantly on standby. Why? Even the best-designed data, provided one day too late, will have no value in building a competitive advantage or responding in advance to risks if the market situation changes during that time.

In the diagram below, I have illustrated the effect of time and selection of the relevant data on the management value, risks emerging for the company and the use of opportunities to build organizational advantage:

Management accounting compiles data obtained internally (mainly from accounting but also from sales, HR, marketing) and then performs data analysis based on information obtained outside the organization. Thus, it considers, among others:

- current geopolitical situation,

- varying legal guidelines,

- macroeconomic indicators,

- trends and risks in the industry.

Such analyses should not only result in information, but also in action scenarios prepared for anticipated changes or events, so-called black swans, of which we have seen a lot recently.

Not a template but a tailored approach

The management accounting and controlling system is not a standard product. In order to be valuable, it must be “tailored” for each organization because there are no two identical companies. When establishing it, the board of directors (or, if it is decided to outsource management accounting, a third party in close cooperation with the board of directors) should carefully consider all processes that take place within the company and assign responsibility for their key elements. It is also important to identify the so-called bottlenecks that cause delays in information flows.

One of the key tasks of management accounting is to provide information on product or service margins, taking into account not only the overall performance of the company (this information is provided by the annual report, compiled by the accounting), but also the performance of individual units. In this way, by breaking down the information into product/service groups, projects, brands or customers, we are able to assess where the company is making and where it is losing money. It may turn out that despite good overall financial standing, there are areas that require significant corrective actions or strategy changes. Taking care of them in good time can prevent significant difficulties in the long term.

Integrating management accounting with financial accounting and controlling creates added value for third-party stakeholders. It enhances the importance of the brand, often with a positive effect on the decisions taken by stakeholders, such as investors or business partners. Besides, knowing the strengths and weaknesses of their organization, the company’s owners gain greater peace of mind and decision-making confidence in a dynamically changing economic environment. And above all, they gain knowledge and time advantage in employing it compared to the competitors who do not use such opportunities.

“True knowledge is knowledge of causes” – Aristotle

As you have already noticed, financial accounting answers not only the question of “how many?”, but also the question of “why?”, as long as we can successfully analyze the data provided.

Expert knowledge of various areas (accounting, HR, finance, legal, tax) is useful for an analysis of management data. By this I do not mean that every owner or manager needs to be knowledgeable, in each of these areas, but rather build up an appropriate pool of advisors. At PKF, when working with our Clients in the area of management accounting and controlling, we very often involve our experts from different departments to create analyses and scenarios. They include lawyers of various specializations, economists, accountants, HR, payroll and IT specialists, tax advisors and business managers or analysts. This wide range of advisors is one of the aspects of cooperation that is most valued by our Clients.

Prevention is better than cure. Therefore, even if your company is just starting out, it is better to already consider establishing a consistent financial and management system, which will develop in parallel. This is definitely a more reliable method than recovery of information when it becomes necessary.

As the company’s owner, would you like your company to be managed by trial and error? I do not think so. Business development and management should be based on solid foundations which PKF will be happy to help you create.

You may be interested

PKF News

News, alerts, and events - Useful, last-minute information.

Wypełnienie pola oznacza wyrażenie zgody na otrzymywanie komunikacji marketingowej. Administratorem danych jest PKF Consult Sp. z o.o. Sp. k. ... więcej

Thank you for your trust! Your address has been saved in our database.