The Polish government introduced the so-called Polish Investment Zone (PIZ). This program is an extension of Special Economic Zones - tax reliefs are available for investments in any location in Poland. All of Poland has become one economic zone.

A zone for micro, small and medium-sized enterprises

The most important changes in the functioning of Special Economic Zones

Who can benefit from the Polish Investment Zone?

Benefits

Criteria for obtaining public aid

Doubts

1. What can be gained:

- tax relief for the ongoing investment

- the possibility of developing the enterprise in its current location

- adjusting the company's strategy to the supported activities

- additional promotion, if the projects are innovative, operate on the basis of R&D and offer employees above-standard benefits

- the possibility of shaping local economic policy

(source: PIZ Szansa brochure for your company, https://www.gov.pl/web/rozwoj-praca-technologia/polska-strefa-inwestycji)

2. The amount of the tax relief

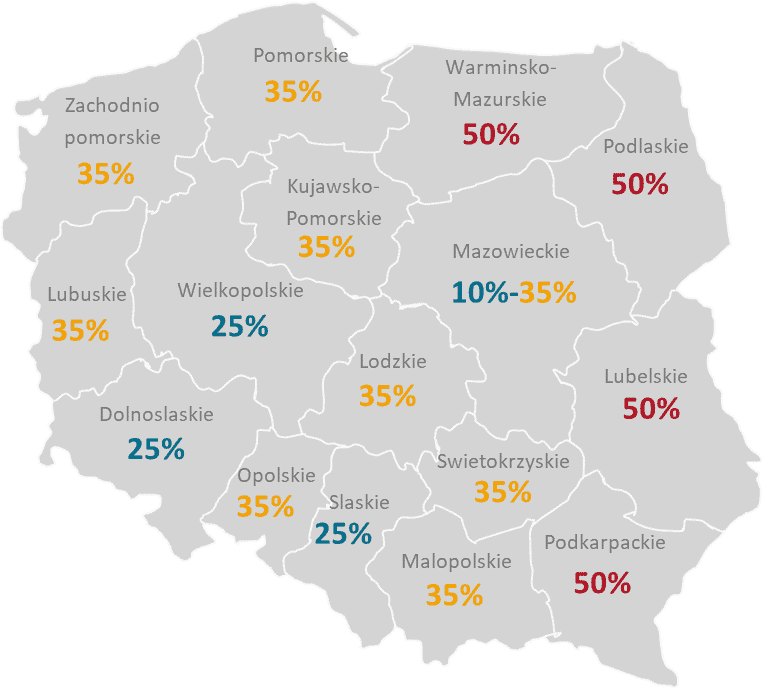

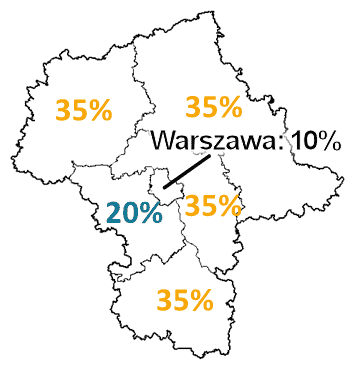

The amount of public aid in the form of CIT or PIT exemption is determined on the basis of the regional aid map for 2014-2020 (constituting% of costs eligible for regional aid):

(source: https://www.paih.gov.pl/strefa_inwestora/Polska_Strefa_Inwestycji#3)

Support for medium and small/micro enterprises is increased by 10 and 20 percentage points, respectively.

The period for which the decision on support is issued depends on the intensity of public aid for a given area. For regions where the intensity is:

- 50% - it is 15 years,

- 35% - this is 12 years,

- Less - 10 years.

Quick contact

PKF News

News, alerts, and events - Useful, last-minute information.

Wypełnienie pola oznacza wyrażenie zgody na otrzymywanie komunikacji marketingowej. Administratorem danych jest PKF Consult Sp. z o.o. Sp. k. ... więcej

Thank you for your trust! Your address has been saved in our database.